The limit is $22,320 in 2025. So, if you earned more than $160,200 this last year, you didn't have to.

What’s the maximum you’ll pay per employee in social security tax next year? We raise this amount yearly to keep pace with increases in average wages.

If you are working, there is a limit on the amount of your earnings that is taxed by social security.

Max Taxable For Social Security 2025 Sarah Cornelle, To determine whether you are subject to irmaa charges,. We raise this amount yearly to keep pace with increases in average wages.

Max Earnings For Social Security 2025 Marji Shannah, You file a federal tax return as an individual and your combined income is between $25,000 and $34,000. Retirement limits, tax brackets and more.

Max Taxed For Social Security 2025 Sukey Engracia, The annual wage base, which reflects the maximum amount of a person's wages subject to social security taxes in a given year. The 2025 limit is $168,600, up from $160,200 in 2025.

2025 Max Social Security Tax Bonnie Chelsae, 57 rows listed below are the maximum taxable earnings for social security by year from 1937 to the present. As your total income goes up, you’ll pay federal income tax on a portion of the benefits while the.

Maximum Taxable Amount For Social Security Tax (FICA), We raise this amount yearly to keep pace with increases in average wages. The annual wage base, which reflects the maximum amount of a person's wages subject to social security taxes in a given year.

2025 Social Security Tax Percentage Josey Mallory, We raise this amount yearly to keep pace with increases in average wages. In 2025, the social security tax limit rises to $168,600.

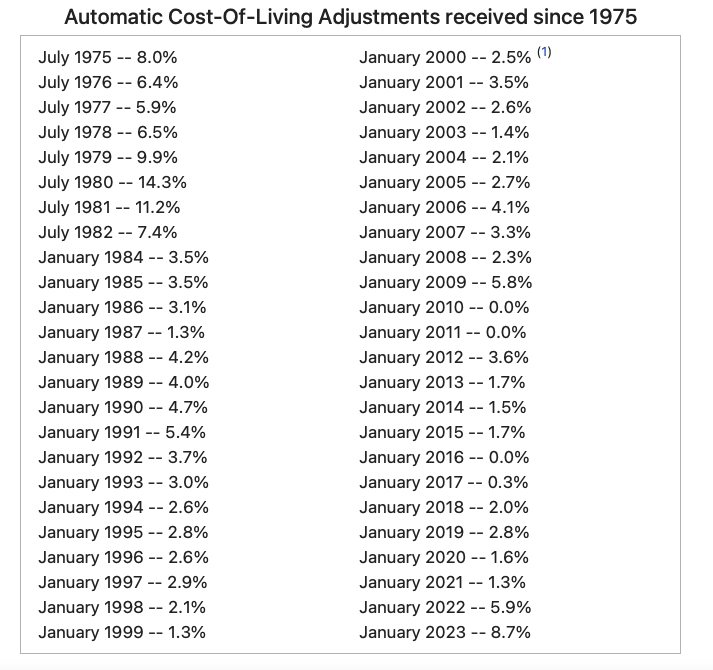

Social Security Maximum Taxable Earnings 2025 Diann Florina, The social security administration (ssa) announced that the maximum earnings subject to social security (oasdi) tax will increase from $160,200 to $168,600. The 2025 cola adjustment raises the total average benefit to $1,907 per month for individual retirees and to $3,033 per.

Social Security Pay Chart 2025 Elise Corabella, (for 2025, the tax limit was $160,200. The social security administration (ssa) announced that the maximum earnings subject to social security (oasdi) tax will increase from $160,200 to $168,600.

Max Social Security Tax 2025 Withholding Table Reyna Clemmie, So, if you earned more than $160,200 this last year, you didn't have to. For 2025, here's how the age you start receiving retirement benefits factors in.

Tax rates for the 2025 year of assessment Just One Lap, What are the 2025 irmaa brackets? But there's a key difference in the context of social security between people earning $20,000 a year versus $200,000.